Why and how to invest in art?

One of the oldest wealth management principles is investment diversification. Even in fairly stable markets, investors care about portfolio breakdown. As evidenced by the data published in Deloitte Art & Finance since 2011, works of art have become a significant form of investing globally. The Deloitte reports present visible growing trends, slightly slower during the pandemic.

The Polish art market is comparatively small, but it is developing extraordinarily fast and the corona virus did not get in its way. According to data from the Central Statistical Office, in 2020 works of art and antiques sold in Poland totaled over PLN 418 million (around $100 million), close to turnovers from the years 2017-2019 combined. The Central Statistical Office reports that 83.1% of this value were in sales of paintings, of which 52.6% are classical works, and 47.4% were modern. The dynamics of the art market in Poland is also confirmed by reports from the portal Artinfo.pl, according to which the record-breaking turnover in the first half of 2021 exceeded the turnover from the corresponding period of the previous year by 72%. This growth is also due to the rising prices of individual works. Observers predict the continuation of these trends in the coming years, and investors are keeping a keen eye on auction houses, galleries and the directions of development of art itself.

A work of art is a safe investment

The value of art is in its uniqueness and does not depend on the financial condition of countries, banks, stock markets or exchange rates. Both the classical and modern tend to appreciate in value with time. Compared to gold, also a material carrier of value, a picture or a sculpture are unique and often bear the hallmarks of the artist’s genius. Hence, their value is independent of the economic situation. An additional benefit for individual investors is that, according to Polish tax law, a work of art can be sold six months after purchase in a tax-free transaction. Buyers rarely use this provision because art is a long-term investment. Profits tend to come after six or seven years, and the big raise in value comes after a dozen or so years.

How to buy art?

Investing in art can be a solely business activity or a creative endeavor—a start or further enrichment of a collection. It is certainly not an area reserved for very wealthy people, one can start with a capital of a dozen or even several thousand zlotys. Works by recognized artists are more expensive, and paintings by those who are just beginning to gain prestige are cheaper. Prepare well for your first purchases or secure the help of a professional. It is worth getting acquainted with trends, by following auctions and browsing catalogs of large auction houses for example, but it is also important to buy what we like, i.e. works that make a great impression on us and which we will want to look at every day. If we find ourselves drawn to works of a very young artist, it is good to check whether they are a laureate of recognized competitions, whether and where their works have been exhibited, and how they’ve been reviewed.

Several factors determine the value of a work of art. First of all, it cannot be a copy of another work, and the author’s signature should be clearly visible. When it comes to the time in which a piece was created, works from the mature period of the artist’s creative career or typical for them tend to be most valuable. Physical features of a painting or object are also important, i.e. the dimensions, technique, and condition. These features cannot always be clearly assessed, especially during one’s early forays into investing in art, so it is safest to seek the help of reputable auction houses and galleries.

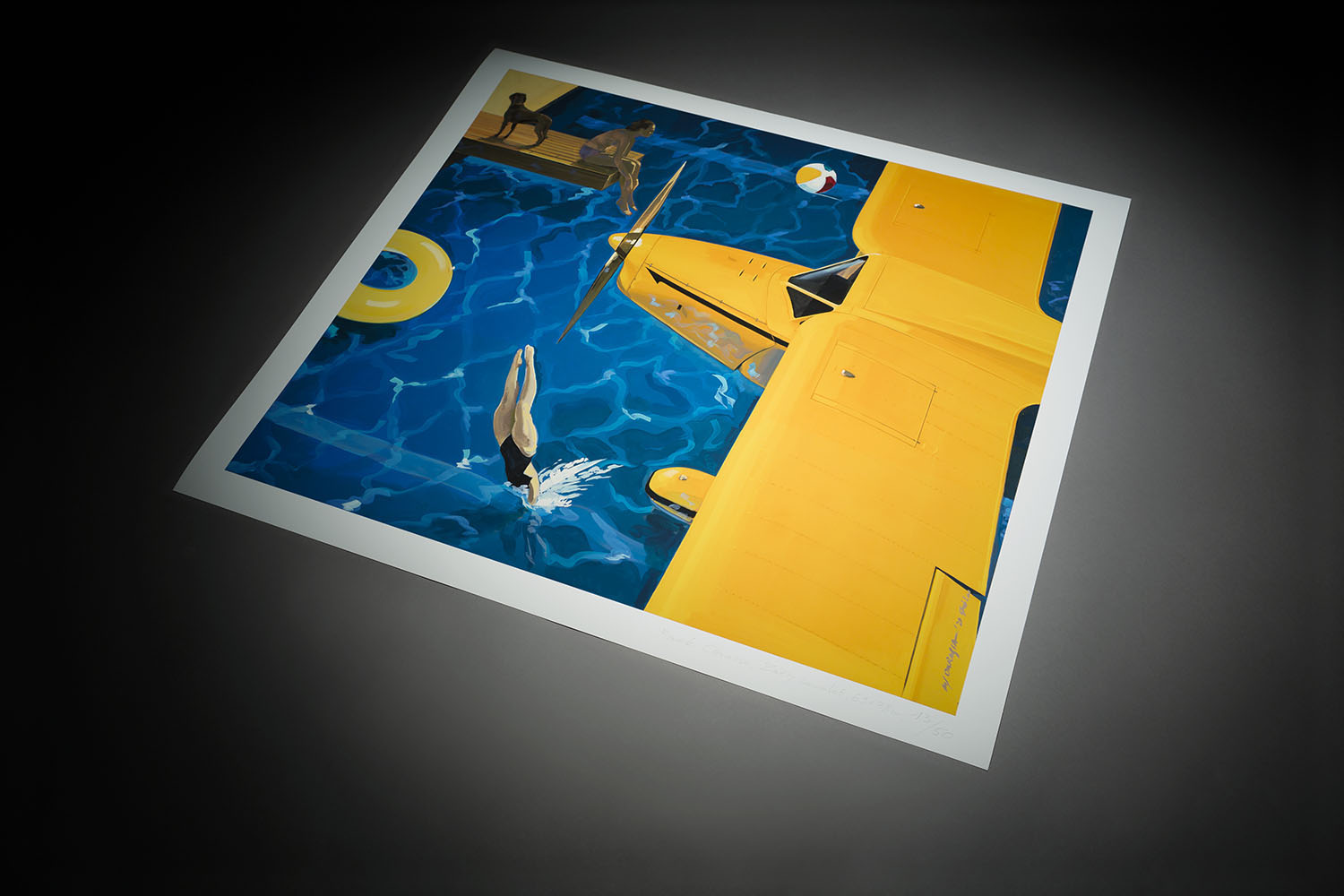

Header illustration: Jadwiga Okrassa, The Pianist, gouache on paper 17×20 cm